Total Confidence with GAP1 Coverage

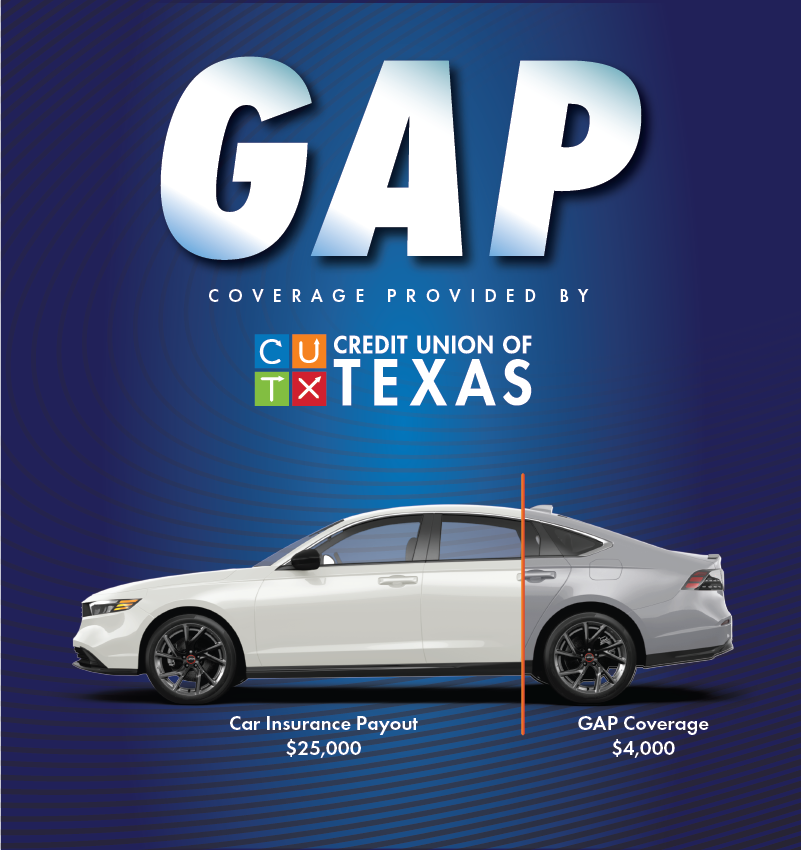

When theft or accidents resulting in total loss occur, standard insurance typically reimburses you for the market value of your vehicle. However, this might not be enough to cover the remaining balance on your loan. This is where GAP coverage steps in!

- Financial Security: Avoid unexpected expenses and protect your financial well-being with GAP coverage.

- Peace of Mind: Drive confidently knowing that you're covered in the event of a total loss or theft.

- Versatility: From motorcycles to travel trailers, our GAP coverage extends to a wide range of vehicles.