Community Engagement

At Credit Union of Texas (CUTX), we believe that community engagement is essential to our mission of serving our members and communities. We can better understand their needs and challenges by actively listening to our members and engaging with the broader community. This helps us develop products and services that genuinely meet their needs and positively impact their lives. Moreover, community engagement allows us to build trust and loyalty among our members. When we work with our members and the community, we can create a stronger, more connected community that benefits everyone.

See how Credit Union of Texas gives back through our events, sponsorships and donations.

CUTX Supports The Community

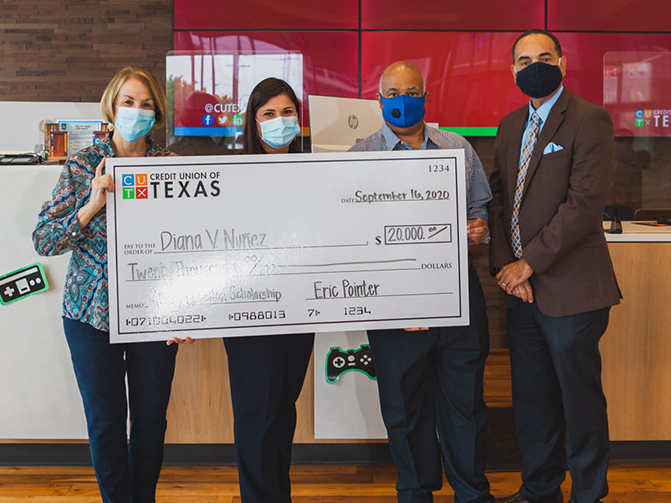

We're committed to actively sponsoring events and causes that enhance the quality of life for our community. Through volunteerism, community sponsorships, and financial education, we strive to make a difference every day. Our staff, members and volunteers have proudly donated time and money to Children’s Advocacy Center of Collin County, Junior Achievement, and Special Olympics, just to name a few. We also support education in a big way — awarding scholarships to members each year.

7,798

Hours of Give Back

Since Jan 2016

139

Different School

Partners

40

Non-Profits Supported

$19,802,084

Donated through

cash and donations

Read What Our Members Love About Us

We donate our time, money, and resources to local charities . We serve educational efforts by supporting teachers and offering scholarships for student members.

We Serve Our Community

Meet our Community Engagement Team

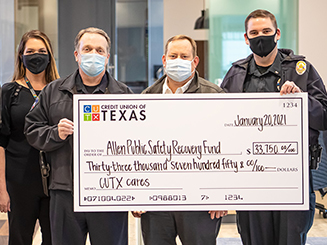

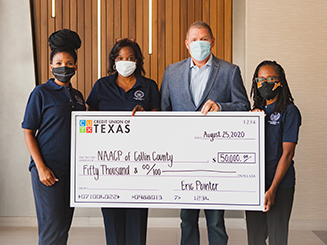

Community Sponsorships & Donations

Credit Union of Texas supports dozens of educational and scholastic initiatives in the greater Dallas area by hosting and sponsoring numerous events and fundraisers benefiting schools, community non-profits, special needs groups, and first responders. To request a donation or sponsorship for an event, email help@cutx.org.