CUTX News

Credit Union of Texas and BankSocial® Bring Self Custody Crypto to Members

Published October 10, 2025

Key Takeaways

-

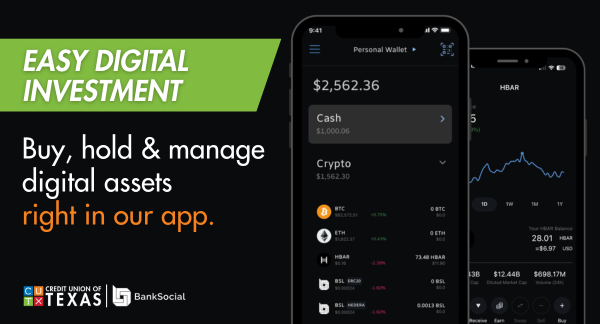

CUTX one of the first credit unions in the US to allow its members to buy, sell and manage digital assets conveniently and securely in online and mobile banking

-

Members can now buy, sell and manage their digital assets, like Bitcoin, Ethereum, Ripple, and others.

ALLEN, Texas, Oct. 10, 2025 – Credit Union of Texas (CUTX) announces the launch of its new digital assets investment platform, created in partnership with leading global financial technology company, BankSocial®. The service makes CUTX one of the first and only credit unions in Texas to offer its members the ability to seamlessly buy, sell and manage their digital assets, like Bitcoin, Ethereum, Ripple, and others.

“Giving our members thoughtful access to emerging financial tools is core to our mission,” said Eric Pointer, President & CEO of CUTX. “We complement the service with clear, practical education, self‑custody, and the convenience of our online banking app, empowering members to explore at their own pace with confidence.”

How it works

- Self‑custody wallet: Members open a BankSocial wallet from their CUTX dashboard and retain full control of private keys.

- Funding: Digital purchases draw from eligible CUTX accounts.

- Convenient Access: Members can buy, sell, or transfer their digital assets within the CUTXMOBILE app.

- Instant liquidity: Sell assets at any time and deposit proceeds straight back into CUTX accounts.

Education built in

To support informed decisions, CUTX produced A Deep Dive into Digital Currencies, a three‑part video series that demystifies blockchain basics, how digital assets work, and best practices for secure investing. Additional FAQs are live at cutx.org, and trained specialists are available through its in-person and online customer service.

“As roughly one‑third of credit‑union members already own crypto, education and security are paramount,” said John Wingate, CEO of BankSocial. “CUTX shares our commitment to people‑first innovation, and together we’re making digital assets simple, safe and local.”

The new digital currency investment platform and educational resources are available to all CUTX members on the CUTX website, https://www.cutx.org/banksocial , and the CUTXMOBILE app.

About CUTX

For almost 100 years, Credit Union of Texas (CUTX) has provided financial services to members throughout North Texas and its growing number of locations in East Texas. Living out its vision to deliver an unexpected experience, CUTX has grown to over $2.6 billion in assets. Most Texas residents may qualify for membership. CUTX also includes its new Spanish-language brand, Todos Unidos created by CUTX (Todos Unidos), which empowers the Hispanic community by delivering accessible financial services, educational tools in Spanish combined with bilingual employees onsite at all CUTX locations.

Recently, CUTX was recognized with the Communities Foundation of Texas “Be in Good Company” Seal of Excellence, voted the Best Credit Union in DFW by the readers of The Dallas Morning News, and named the winner of the Torch Awards for Ethics from both the Better Business Bureau Serving North Central Texas and the International Association of Better Business Bureaus.

For more information about CUTX, visit www.cutx.org, and to learn more about the Todos Unidos created by CUTX experience, visit https://www.todosunidos.us/.

About BankSocial

BankSocial® is a passionate team of credit union and DLT experts who are merging the world of credit unions with the world of DeFi to create a financial ecosystem that unites and empowers people and businesses with fair and equitable access to the same financial tools for all with no bias or selective access. To learn more about BankSocial, visit www.banksocial.io.